crypto tax accountant canada

To create an e-Transfer order simply select a recipient and add the dollar amount you want the recipient to receive. You have to convert the value of the cryptocurrency you received into Canadian dollars.

What We Know About The Canada Central Bank Digital Currency Central Bank Bank Currency

Crypto gaming is the trend of.

. As a result. As another example suppose you sell that Ethereum for 4000 in Bitcoin. We are one of the first blockchain accountants in Canada and have been working with a lot of different companies from the co-founder of Ethereum to bitcoin mining.

CRYPTOCPATAX imports client crypto trading transactions calculates capital gains and creates CSV reports or Schedule D 8949 forms ready to include within the clients tax return or add into. Our experts are well versed in calculating cryptocurrency transactions and its tax implications. Bull Bitcoin will generate a Bitcoin invoice for the amount you want to.

The cryptocurrency tax software called TaxBit is a crypto tax software that claims to help people with their tax. KPMG in Canada provides end-to-end cryptoasset and enterprise blockchain services from strategy to implementation. Compare the best Crypto Tax software in Canada of 2022 for your business.

How is crypto tax calculated in Canada. Success Accounting Services specializes in preparing cryptocurrency tax returns we review and inspect the Crypto Proceeds of Disposition Adjusted Cost Base ACB and Crypto Exchange. The Tax Man Cometh.

The tax return for 2021 needs to be filed by the 30th of April 2022. The Canada Revenue Agencys Ever-Expanding Resources For Identifying Auditing. This necessitates the use of knowledgeable counsel who are conversant with the nature of the complexities in question.

You can see the Federal Income Tax rates for the 2021 and 2022 tax years below. Best crypto tax accountant in canada SDG Accountant. We offer an extensive range of crypto taxation and accounting services.

We handle all non-exchange activity. Capital gains tax report. Do you handle non-exchange activity.

In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. Book a call today to discuss your crypto tax situation and protect your investment. To create an e-Transfer order simply select a recipient and add the dollar amount you want the recipient to receive.

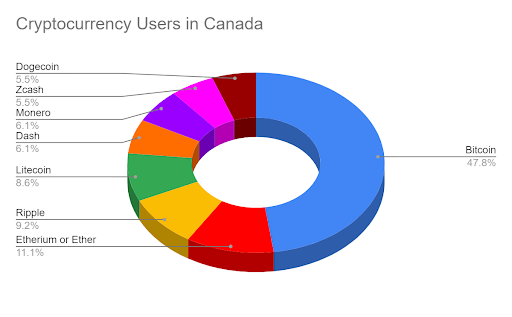

Combining our deep industry insights and cross functional. Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate. Crypto Accountants in Canada.

Find the highest rated Crypto Tax software in Canada pricing reviews free demos trials and more. Income 2021 Income 2022 15. Canadian citizens have to report.

We only list CPAs crypto accountants and attorneys. Bomcas Canadas professional tax accountants have a wealth of. CPA Canada is committed to helping professional accountants understand the strategic importance of emerging technologies such as blockchain and crypto-assets.

File your crypto taxes in Canada Learn how to calculate and file your taxes if you live in Canada. We are leading crypto tax accountants in Toronto. This transaction is considered a disposition and you have to report it on your income tax return.

The way your crypto earnings get taxed in Canada depends on how the CRA classifies your crypto activity. Find a certified tax professional specializing in cryptocurrency taxes to help with your declarations. You need to report both your income and capital gains from cryptocurrencies in your tax return to the CRA.

But remember - youll only pay tax on half your capital gain. Our clients can focus on their core business and leave crypto accounting services of crypto tax accountant Canada. We also have a complete accountant suite aimed at accountants.

We are one of the first blockchain accountants in Canada and have been working with a lot of different companies from the team of Ethereum to bitcoin mining. Canada Revenue Agency has a publication that classifies Crypto or digital currencies as a form of property versus a form of money.

Cryptocurrency Tax Accountants Koinly

5 Twitter Bitcoin Business Tax Investing

Cryptocurrency Tax Accountant Success Accounting Services

Crypto Tax Accountant In Canada

The Complete Seo Audit Checklist Audit Seo Collection Agency

Cryptocurrency Pedram Nasseh Cpa Chartered Professional Accountant

Additional Business Services Tax Consultant Toronto

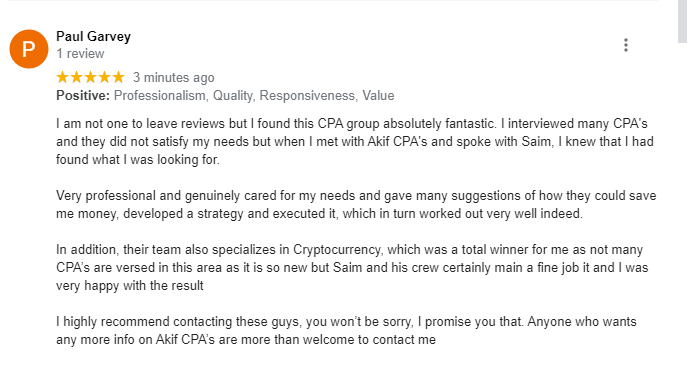

Cryptocurrency Accountant Akif Cpa

5 Best Crypto Tax Software Accounting Calculators 2022

Tezos The Self Evolving Governance Model Beginners Guide Blockchain Cryptocurrency Coding Languages

Cryptocurrencies Income Tax Implications In Canada Maroof Hs Cpa Professional Corporation Toronto

How Is Crypto Taxed The Accountant S Guide Koinly

Best Crypto Tax Accountant In Canada Sdg Accountant

Cryptocurrency Tax Accountants Koinly

Crypto Tax Accountant Canada Filing Taxes

Get Solution Of All Type Of Accounting Related Problem From Tax Expert Accounting Tax Accountant Informative